Bridging generational divides to co-create the future

Bridging generational divides to co-create the future

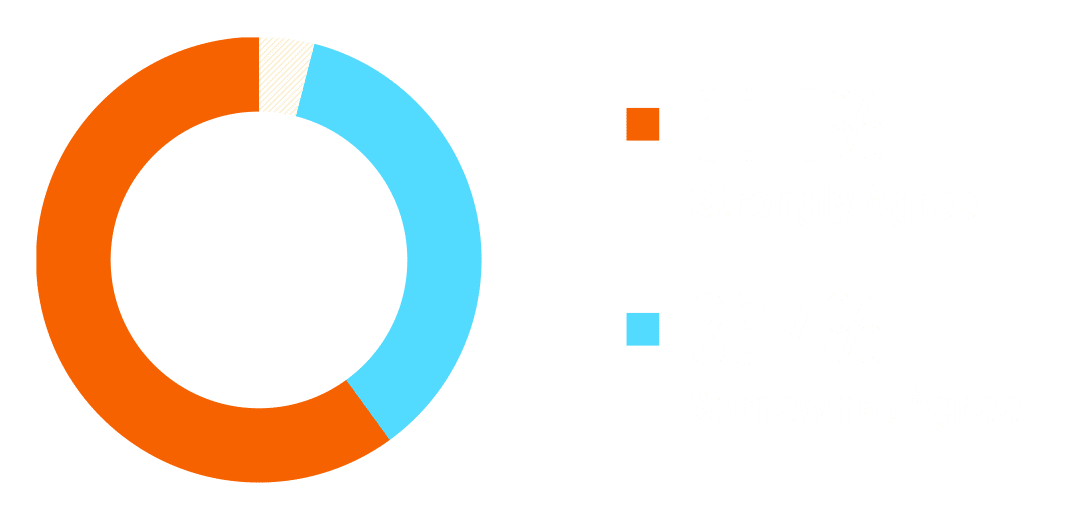

People of all ages want to work across generations to help others and improve the world around them.

Working across generations can help America better solve its problems.

Working across generations can reduce divisions in our society.

What’s New

Here’s what’s happening at CoGenerate!

OLDER AND YOUNGER

COGENERATING CHANGE

We’re shining a light on powerful examples of cogeneration to change the narrative from generations apart to generations together.

Check out 10 things we look back on with pride.

Check out the 10 things we can’t wait to do next.

Review our 5-year plan.

Invest in our future.

Check out 10 things we look back on with pride.

Check out the 10 things we can’t wait to do next.

Review our 5-year plan.

Invest in our future.

We run programs that support and accelerate cogeneration in the social sector.

*

Generations Serving Together →

Offering incentive grants to age-integrate national service programs

*

Encore Physicians →

Placing retired physicians at health clinics to treat underserved people and mentor younger colleagues

SIGN UP

Cogenerate with us!

SIGN UP

Cogenerate with us!